Acquiring users for Fab Money's prepaid card

Product - Fab Money (formerly known as Pepper Money) Prepaid Rewards Card

Elevator Pitch - Fab Money has launched a prepaid rewards card for the emerging cities of India. Every payment made with the card earns the user instant cashback. For our launch cities of Lucknow and Indore, we have special cashback offers at eminent local merchants over and above the regular 1% cashback we give all users. It solves the problem of bringing rewards to the population of the emerging cities of India, who often don't get the best credit cards and are thus reward-hungry.

Business Goal

Fab Money wanted to launch as the fintech brand for the emerging Tier 2 and tier 3 cities of India. The prepaid rewards card was an acquisition product to potentially cross sell loans and co-branded credit cards to the users.

Understanding the product

What are we solving?

Consumers in Tier 2 and Tier 3 cities of India (eg. Lucknow, Pune, Indore, Chandigarh, etc.) were not catered with the right set of rewards because of low credit card penetration, UPI being 'rewardless' and debit card having no rewards. Fab Money launched the most rewarding prepaid card in India which provided instant cashback on all purchases (except rent and education). We also had a city themed proposition wherein those cities had a city customized card and rewards at some of the top merchants in the city.

Product features and description

Fab Money has launched a prepaid rewards card with the following features

- 1% instant cashback on all purchases made with the card (except rent and education fees)

- Most secure way to pay - since the bank account is not linked to the card

- Zero joining and annual fees, zero charges for physical card

- No approval process - since its a prepaid card, it has no need for credit score or any approvals

- Localized offers - for the launch cities of Lucknow and Indore, there were special offers from some of the famous local merchants across different categories

- Digital card and card controls available on the Android and iOS app

- Offers from national brands like Zoomcar, IGP, Ixigo, etc.

Research on user feedback

Technofino Forum:

Technofino is a forum where early adopters of cards and banking products users engage to give feedback on new products and also find the latest rewarding offering

Insight: Some of the messaging around a city-based prepaid rewards card has led to more confusions than excitement because users were unaware if the card can be used everywhere. Also 1% cashback had to be informed better that it would be available to the user in their card balance directly. Messaging around 'no credit score inquiry' had to be stressed on more.

Insight: Some of the messaging around a city-based prepaid rewards card has led to more confusions than excitement because users were unaware if the card can be used everywhere. Also 1% cashback had to be informed better that it would be available to the user in their card balance directly. Messaging around 'no credit score inquiry' had to be stressed on more.

Insight: Our onboarding experience had been great because we hardly saw any drop in funnels in the digital card creation process. Customers from all over India were attracted to the 1% cashback proposition

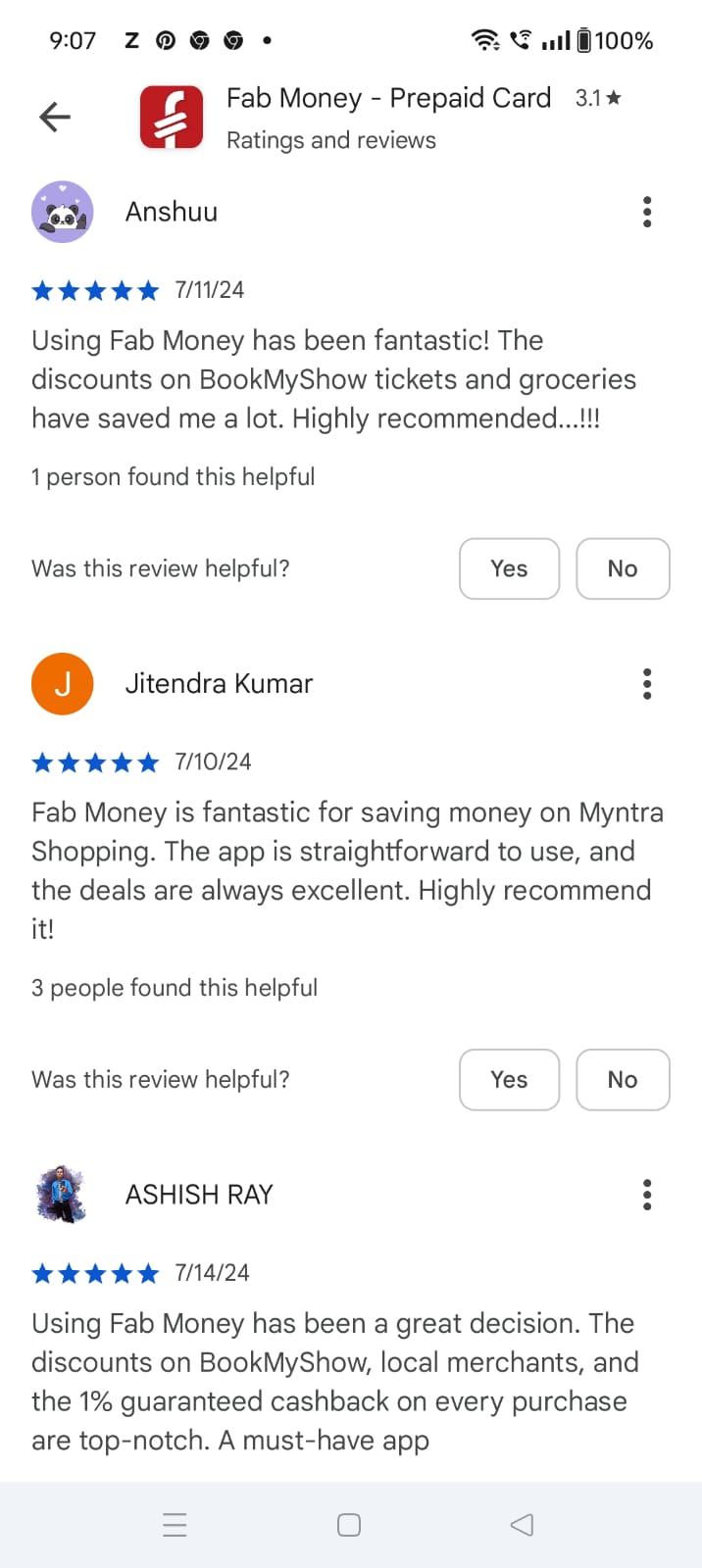

Google Playstore:

Insight: Positive reviews on the cashback experience and the design of the card. Negative and critical reviews on the product having sub-par customer support.

User calls:

Occupation | Gender | City | Age | How did they find out about the product? | What do they say about the product? |

|---|---|---|---|---|---|

Businessman with a wholesale business for sarees | Male | Indore | 25 | Instagram ads | He loves the cashbacks and uses the product wherever his credit card does not give him a deal. He wasn't aware of the Indore region specific offers. He wants a referral program to gain benefits from suggesting the product to his friends |

Student in the final year of graduation | Male | Lucknow | 22 | On-ground activation team | He used the product for booking bus tickets on Goibibo, food from Swiggy, fuel, Reliance Retail and Zudio. He is a power user now because of the cashback. He has complained about the support being slow and unresponsive. |

Student in 11th grade | Male | Jaipur | 17 | YouTube video | He found the product as one of the few payment products that benefit teens. He uses it for all his expenses because of the instant cashback. He wants more online offers from brands like Myntra and Flipkart. He has recommended the offer to a lot of his friends |

Professional working in a lending firm | Female | Mumbai | 38 | GFF launch event | She has been using the cashback rewards wherever her own credit card or debit card does not give rewards. She has complained that there are places where the card is not accepted but as an informed customer she knows its the merchant who is not accepting it. She complained about the support team's awareness and also about facing slowness in the app at times to add money. |

Local store owner | Male | Kolkata | 30 | YouTube video | He is a rewards hunter who is always on the lookout of products that give cashbacks or deals. He does not have loyalty to any product and shifts quickly between products when he finds a better deal |

Transporter with a fleet of trucks | Male | Lucknow | 40 | On-ground activation team | He liked the card since we gave cashback on fuel. He owns 40+ trucks and plans to onboard each of his drivers, he plans to load fixed amounts on their card for petrol and food needs and benefit from the rewards. |

Banker with a teenager living in Chennai | Male | Mumbai | 45 | GFF Launch event | He liked that his bank account is decoupled from the prepaid card and hence finds the card safe. He also finds the transaction statement helpful for him to track his son's spends |

YouTube:

User generated content with no nudge

User generated content with no nudge

'Card for minors' hook had multiple videos

'Card for minors' hook had multiple videos

Card and kit unpacking videos

Card and kit unpacking videos

Card payments shown in action by local under-18 influencer

Card payments shown in action by local under-18 influencer

Insight: Users (especially influencers) were excited about the card's proposition and its look and feel. Features like a small KYC prepaid card, open to users below 18 years of age, a lifetime free card, and cashback were wins for the customer.

Understanding the users

Ideal Customer Profile

ICP 1 | ICP 2 | ICP 3 | ICP 4 | |

|---|---|---|---|---|

Ideal Customer Profile Name | Early career professional | The deal hunter | The small business owner | The smart parent |

Age | 20-30 | 18-50 | 35-55 | 30-50 |

Occupation | Salaried professional | Student/Salaried/Businessman | Businessman | Salaried/Businessman |

Where do they shop? | Zudio, Vishal Mega Mart, Amazon, Ajio, Malls | Wherever they get the best deals - usually online shoppers | Zara, Westside, Myntra, Malls | Ajio, Amazon, Malls, Lifestyle, Shoppers Stop |

Where do they spend time on the internet? | Instagram, Whatsapp | Instagram, Forums, Telegram, X, Reddit | Whatsapp, Facebook, X | Whatsapp, Facebook |

Average monthly expenses | INR 10,000-20,000 | INR 10,000-50,000 | INR 75,000 - 1.5 lakh | INR 75000 - 1.5 lakh (their own spends) |

Where do they live? | Tier 2, Tier 3 cities | Tier 1, 2, and 3 cities | Tier 1, 2 cities mainly (rich families in tier 3 too) | Tier 1 cities |

What are the financial products they currently use? | Majorly UPI followed by basic credit cards | Whichever product provides the best deal at point of sale | Credit cards, UPI | Credit cards, UPI, cash |

Pain points |

|

| they need a prepaid card/wallet solution for their drivers, factory workers, employees for spends like petrol bills (in case of drivers), bonuses and monitored spending |

|

Core motivations to switch from the existing way of spending | Rewards and cashback. Saving money while spending is a big hook for them since they often operate on tight budgets | Cashback and the best deal in town. These users often are part of forums and communities where they brag about their finds | They want a controlled environment of spends to monitor where their employees are spending. This ICP does not care much about the cashback or rewards but they are a plus for employee experience | Decoupled from their bank account and hence safest way to pay; acceptable for online and offline payments, cashback & rewards |

ICP Prioritization

ICP categories | Monthly GMV | Market size | Lending opportunity | Adoption curve | Frequency of use case | Distribution potential |

|---|---|---|---|---|---|---|

Early career professional | High | High | High | High | High | High |

The deal hunter | High | Medium | High | High | High | High |

The small business owner | High | Medium | Low (since Fab Money don't wish to get into B2B lending) | Low | High | Low |

The smart parent | Low | Low | Low (since parents are served by banks and their children are not lendable) | Medium | Low | Low |

Conclusion: Based on the above scoring, it is clear that the primary ICP to target will be that of an early career professional followed by the deal hunter. This prioritization is in line with the company's goal to eventually enter the consumer lending space, with the prepaid card being an acquisition product.

Understanding the market

The major competition for this category is UPI payments because of its ubiquitous and low-cost nature, followed by credit card payments. The average ticket size (ATS) of merchant transactions on UPI is less than ₹800 and we hope to have an ATS of >₹1000 so that the user also finds the value behind the cashback amount.

In the prepaid card space, after the RBI regulations around credit lines on prepaid payment instruments (PPI), players like Slice have all pivoted out of this space. What are left are competitors like Omnicard, Anq Finance, Fampay and Junio. However, there are e-wallet players like Airtel Money, Amazon Pay, etc. that also fall under the PPI bucket.

Feature | All UPI apps | Junio | Famapp (FamX card) | ANQ Finance |

|---|---|---|---|---|

Core problem being solved | Ease of payments, acceptability everywhere, no extra charges for customer | Provide kids with pocket money in a card and financial education | Cool way to pay for teens and young adults | Control your expenses and budget your payments |

Target Audience | 18+ citizens of India | Teens and children (pocket money account) | Teens and young adults | Reward hunters |

Fees | Nil | One-time purchase cost | Charges for physical card/ membership, platform fees, account maintenance fees and premium subscription charges | ₹1500 one-time platform fees |

Rewards | Negligible. Limited to discount vouchers by brands or minimal cashback (just as an acquisition hook) | Cashback and discounted brand vouchers | Famcoins given that can be redeemed to offers and discounts | Bounties in the form of digital gold or BTC |

GTM strategy | Depending on the app in question. Ranging from tv ads to OOH to performance marketing etc. | Instagram, giveaways | Instagram, influencer marketing, performance marketing | Instagram, LinkedIn |

What is Fab Money's right to win? | Instant cashback on every spend |

|

|

|

What can Fab Money learn from them? | (Different product altogether) | Consistency with content production and community engagement strategies | Membership breakdown into tiers to drive more revenue and differentiate features | ANQ has a cobranded credit card too and hence they can offset the burn on this product through interest income from credit card. Product economics done well |

TAM SAM SOM Calculation

Assumptions for calculations :

- We will only be targeting the urban population of India

- Though anyone with a valid PAN card can create a card, we will target only 18-50 yo individuals

- Total Urban Population = 30% of Indian population = 30% of 1.3Bn = 390Mn

Total Addressable Market : ₹7Bn

Serviceable Addressable Market : ₹1.2Bn

Serviceable Obtainable Market : ₹23Mn (as of July 2024)

Please find the detailed calculations in the sheet below. In case the embedding is not accessible - find the attached sheet

Reference check to test sanity on the numbers : The total prepaid card market is estimated to be $36Bn in 2023 growing at a CAGR of 29.7% (source - Globenewswire). This consists of all prepaid instruments like open loop, closed loop, gift cards, wallets etc.

Core value proposition

Fab Money prepaid rewards card provides instant cashback to users on every payment they make. For the launch cities, it also provides special cashback deals at partner merchants across categories. With its 1% cashback proposition, its better than a lot of credit card rewards as well in terms of cashback. Finally, it is the safest way to pay as it does not connect to the bank account. This point particularly bears well for our target audience as they are often paranoid with financial fraud.

The product (when I left the company) had >40k customers with the card but our retention numbers weren't up to the mark. Also, we faced difficulties with ensuring a great customer support experience to the users leading to a decline in reviews and reputation. A lot of it was because we didn't have a proper acquisition strategy and we went across multiple channels (performance marketing, affiliate, referral, etc.) without keeping a check on the costs and the feedback from the customers. The company has currently paused business operations.

My experiments below are a way to apply the learnings from the lecture and also how to make the channel cheaper, feedback driven and faster.

Fab Money prepaid rewards card was the most beneficial for users in Lucknow and Indore - our two launch cities. The thesis was that this card will be the most preferred card in tier 2 and 3 cities. For Lucknow and Indore, the card designs too were different - Rumi Darwaza card design for Lucknow and Rajwada Palace design for Indore. With Lucknow having ~4Mn population and Indore having ~3.4Mn population, the sample size of the potential early adopters for the product is significantly high.

Hence, in the pre-PMF stage, I will be testing the thesis of a city specific rewards card, the fit of instant cashback as a rewarding mechanism and also gain overall feedback on the product's central proposition of 1% cashback. Moreover, ICP 2 for the product will be reached out to via forums and Telegram channels to gain users from cities outside of Lucknow and Indore.

I will be designing experiments on organic and content loops.

Experiment 1: College Ambassadors

💡Insight: From the customers in ICP 1 I spoke to, I learnt that they never searched for the product on Google nor do they do that with any of their financial products (unless its a credit card). They were told about the product from a family member or friend and directly downloaded the app. There were also some users who said that they downloaded the app after seeing the cashback promise but never bothered to Google much about it.

🎯Actionable: The job to be done would be to create product ambassadors who will champion our cause to potential customers

Who are these ambassadors: General secretaries or college council folks from Lucknow and Indore colleges (in the final year of college)

Why these ambassadors: Our ICP 1 are the early career professionals and often the final year students are just gearing their way to start their careers and manage their finances. They also have a social life that can be leveraged upon from a rewards standpoint

Example of colleges: Lucknow - Amity University, Integral University.

Indore - Prestige Institute of Management and Research, DAVV University, SGSITS Indore.

Why these colleges: Most of these are private colleges having students who have a higher disposable income compared to government colleges where often a vast majority of people come from surrounding villages in both the cities

Experiment description: College ambassador's tasks will be as follows:

1- Actively spread awareness of the brand and the product in fests and college events

2- Get feedback from students for improvement in product

3- Conduct engagement activities for eg. "Who scores the highest cashback?" leaderboard

4- Provide feedback around the choice of merchants that are added to the platform and if that matches with the places students go

Additional considerations : To further support the college ambassadors, content strategy focused to both the cities has to be created that talks about areas where the card can be used. For eg. Top 10 places to be this weekend in Lucknow/Indore; Top 5 places where Fab Money card gives the best deal; Best places in Lucknow/Indore for local shopping; etc.

The content mentioned above will be hosted on our website to help us from an SEO standpoint as well

Potential reach : Assuming there are on an average 400 students graduating from each of these colleges at any time -> ~2000 users across Lucknow and Indore.

While the number seems low, the network effects of this cohort can be enormous and we can acquire users through word of mouth

Hypothesis: For fintech products, often influencers (not "finfluencers" but trusted friends who are early adopters) and a strong trusted word of mouth is crucial for adoption. College ambassadors along with their activity will help us acquire users who will be a part of the ICP 1 cohort. Furthermore, since the cohort of users targetted with this strategy is often the most social and open to new experiences, they can provide us feedback on the quality of merchants in both the cities and also provide strong WOM for more users.

Experiment 2 : Active participation in forums

💡Insight: ICP 2 (The deal hunter) are present across fintech forums and groups where they often get information around the best rewards, 'loots' and best cards in the market.

🎯Actionable: The job to be done would be to be present where the users are and engage with them in the forum

Community examples: Jupiter community, Technofino, Telegram groups of people who uploaded YouTube videos, Facebook groups

Audience description: The people inside such communities and groups are the early adopters of the product who give us quick feedback on features. Retaining such users is difficult since they are only here till the time we have a good deal on the table but in the initial days of building the product, these users can be power users.

Experiment description: For channels where company participation is allowed - join as a customer success associate. For channels where it is not - join as a member and push conversations in the community related to the product

Themes of communication: 1- Preview of upcoming product features through interactive videos and images.

2- Blogs on making the most from the Fab Money card (cashback maximization techniques)

3- Comparison blogs with competitors and also some low reward credit cards

The themes mentioned above all will be hosted on our website in the form of blogs or videos to help us from an SEO standpoint as well

Additional considerations: In our user calls, we observed that since these were power users, they often seemed to have the most issues in terms of customer support. Being a part of these communities helps us in being more available to solve some of these problems and also increasing trust.

Potential reach: ~20,000 users across forums, Telegram channels and groups

Hypothesis: Being closest to the customer can have compounding gains, especially at a pre PMF stage. Having observed the range of issues that have been raised to the support team, being preventive and informing the customer will be very helpful. This can also help us build the type of features which the users want.

Moreover, the content produced during the execution of this experiment will help us in our SEO journey as well.

As a new product, it is important to have some of the nuances around offer configurations and features tested by core/power users. With the aim to be "the most rewarding prepaid card" in India, this cohort is crucial for the journey to achieve product market fit.

Experiment 3 : Flaunt your city card

💡Insight : In my calls with customers from Lucknow and Indore, I have realized that they are very proud of their cities and their identities. They love stories and also love how there is so much culture in their cities.

🎯Actionable : The job to be done will be to make them flaunt their city customized card to people

Background : For Lucknow and Indore, the card designs were different - Rumi Darwaza card design for Lucknow and Rajwada Palace design for Indore.

Experiment : Ask the user to flaunt their physical card next to their favourite place in the city and the best pictures will be broadcasted on our Instagram social channels. We will be creating specific Instagram background filters to brand the images with Fab Money's name.

Hook : The city specific physical card with the corresponding background filter

Content Creator : Users from Lucknow or Indore with the physical card

Distribution Channel : Instagram, Facebook

Flow : User clicks a photo of the physical card with their favourite place in the city as background with a hashtag. #FabLucknowi for Lucknow users; #FabIndori for Indore users

Success criteria : 1- Number of posts created with the filter and shared

2- Brand awareness in each of these cities

3- Increase in number of physical card orders

4- Increase in spends at partner merchants

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.